Throughout his election marketing campaign final 12 months, Donald Trump promised Individuals he would usher in a brand new period of prosperity.

Now two months into his presidency, he is portray a barely completely different image.

He has warned that it will likely be onerous to carry down costs and the general public needs to be ready for a “little disturbance” earlier than he can carry again wealth to the US.

In the meantime, whilst the most recent figures point out inflation is easing, analysts say the chances of a downturn are rising, pointing to his insurance policies.

So is Trump about to set off a recession on this planet’s largest economic system?

Markets fall and recession dangers rise

Within the US, a recession is outlined as a chronic and widespread decline in financial exercise sometimes characterised by a bounce in unemployment and fall in incomes.

A refrain of financial analysts have warned in current days that the dangers of such a state of affairs are rising.

A JP Morgan report put the possibility of recession at 40%, up from 30% firstly of the 12 months, warning that US coverage was “tilting away from progress”, whereas Mark Zandi, chief economist at Moody’s Analytics, upped the chances from 15% to 35%, citing tariffs.

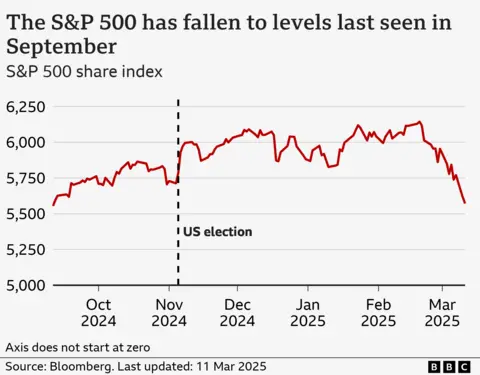

The forecasts got here because the S&P 500, which tracks 500 of the most important corporations within the US sank sharply. It has now fallen to its lowest degree since September in an indication of fears concerning the future.

The market turmoil is being pushed partly by considerations about new taxes on imports, referred to as tariffs, which Trump has launched since he took workplace.

He has hit merchandise from America’s three largest commerce companions with the brand new duties, and threatened them extra extensively in strikes that analysts imagine will improve costs and curb progress.

The newest official inflation figures within the US confirmed the speed of worth will increase cooling in February, nonetheless.

Costs had been up 2.8% over the 12 months to February, down from 3% in January, the Labor Division stated.

Nonetheless, Trump and his financial advisers have been warning the general public to be ready for some financial ache, whereas showing to dismiss the market considerations – a marked change from his first time period, when he ceaselessly cited the inventory market as a measure of his personal success.

“There’ll at all times be modifications and changes,” he stated final week, in response to pleas from companies for extra certainty.

The posture has elevated investor worries about his plans.

Goldman Sachs final week raised its recession bets from 15% to twenty%, saying it noticed coverage modifications as “the important thing threat” to the economic system. However it famous that the White Home nonetheless had “the choice to tug again if the draw back dangers start to look extra severe”.

“If the White Home remained dedicated to its insurance policies even within the face of a lot worse knowledge, recession threat would rise additional,” the agency’s analysts warned.

Tariffs, uncertainty and slowing progress

For a lot of companies, the most important query mark is tariffs, which increase prices for US companies by placing taxes on imports. As Trump unveils tariff plans, many corporations are actually going through decrease revenue margins, whereas holding off on investments and hiring as they fight to determine what the longer term will appear like.

Traders are additionally nervous about large cuts to the federal government workforce and authorities spending.

Brian Gardner, chief of Washington coverage technique on the funding financial institution Stifel, stated companies and traders had thought Trump meant tariffs as a negotiating instrument.

“However what the president and his cupboard are signalling is definitely an even bigger deal. It is a restructuring of the American economic system,” he stated. “And that is what’s been driving markets within the final couple of weeks.”

The US economic system was already present process a slowdown, engineered partially by the central financial institution, which has saved rates of interest larger to attempt to cool exercise and stabilise costs.

In current weeks, some knowledge suggests a extra speedy weakening.

Retail gross sales fell in February, confidence – which had popped after Trump’s election on a number of surveys of customers and companies – has fallen, and corporations together with main airways, retailers corresponding to Walmart and Goal, and producers are warning of a pullback.

Some analysts are nervous a drop within the inventory market may set off an additional clampdown in spending, particularly amongst larger earnings households.

That would ship a significant hit to the US economic system, which is pushed by shopper spending and has grown more and more depending on these richer households, as decrease earnings households face stress from inflation.

The top of the US central financial institution, Jerome Powell, supplied assurances in a speech final week, noting that sentiment had not been indicator of behaviour in recent times.

“Regardless of elevated ranges of uncertainty, the US economic system continues to be in place,” he stated.

However the US economic system is at the moment deeply linked to the remainder of the world, warned Kathleen Brooks, analysis director at XTB.

“The truth that tariffs may disrupt that on the similar time that there have been indicators that the US economic system was weakening anyway … is absolutely fuelling recession fears,” she says.

Inventory market in tech ripe for correction

The unease within the inventory market is not all about Trump.

Traders had been already jittery about the potential of a correction, after large good points over the past two years, pushed by the sharp run-up in tech shares fuelled by investor optimism about synthetic intelligence (AI).

Chipmaker Nvidia, for instance, noticed its share worth bounce from lower than $15 firstly of 2023 to just about $150 in November of final 12 months.

That kind of rise had stirred debate about an “AI bubble” – with traders on excessive alert for indicators of it bursting, which might have a huge impact on the inventory market, whatever the dynamics within the wider economic system.

Now, with views of the US economic system darkening, optimism about AI is getting even more durable to maintain.

Tech analyst Gene Munster of Deepwater Asset Administration wrote on social media this week that his optimism had “taken a step again” as the possibility of a recession elevated “measurably” over the previous month.

“The underside line is that if we enter a recession, it will likely be extraordinarily tough for the AI commerce to proceed,” he stated.